Virtual assistant mortgage brokers are acquired no money down

Because the World war ii, the fresh service now-known once the Service out-of Experts Situations (VA) has actually offered home ownership of the pros the help of its financial warranty system. This choice allows a veteran to find a home loan out of an exclusive lender on significantly more good words than usual (such as for example, in place of a required down payment).(1) When property foreclosure occurs, VA’s warranty decreases the lender’s potential losses.(2) The brand new ratio of your own mortgage dominant that is secured may vary which have how big the loan financing (it can not be more $46,000).(3) Inside the 1992, this new Bush management projected the fresh new program’s net federal outlays (financing charges gotten than property foreclosure and program working will cost you) within $740 million.(4)

Until 1982, the government thought a complete cost of the applying, and also at that point, created a single-time Va financing resource fee.(5) Currently, the price tag are 2 % of your own financial number getting loans having down money out of below 5 percent, step 1.5 % to own financing which have down payments anywhere between 5 % as much as ten percent, and you will step one.25 percent having financing with off payments regarding ten percent or alot more. While doing so, the brand new Va charges is generally paid in dollars in the closure or as part of the amount borrowed and you may financed from the experienced more living of the financial.

Possible people cannot pick land that have antique or Government Casing Government (FHA) financial support in the place of off payments (5 % minimal fundamentally pertains to conventional mortgage loans and you can step 3 % in order to FHA mortgage loans). FHA, but not, it allows closing costs is included in the loan amount, when you are Virtual assistant does not.(6) Brand new FHA financing leads to an optimum mortgage that is not from a no deposit.(7)

When FHA or traditional investment was obtained, an insurance superior is billed. Such, FHA demands a great step 3 % commission beforehand, and a fee every month according to an annual speed regarding 0.5 percent of your loan amount (the fee can be fundamentally end up being terminated in the event the value of brand new possessions is higher than 80 per cent of home loan count). The fresh rates energized from the personal financial insurers include providers in order to organization. One individual insurer cited a 1 % up-front percentage that can’t getting financed of the consumer (but may be paid because of the merchant at closure in some circumstances), and a yearly commission off 0.forty-two % of one’s loan amount paid every month, before the financial don’t requires the insurance (basically, if the loan amount drops below 80 per cent of your own really worth of the house additionally the borrower applies to possess discharge of the fresh new insurance rates duty). The fresh new Virtual assistant financial program will not fees an insurance coverage premium.

Also all the way down loan costs and the capability to receive no-money- off funds, Virtual assistant qualifying requirements be a little more lenient than other apps. Consequently, experts located a substantial work for when compared to most other home buyers who have fun with FHA or antique money.

A supply regarding the has just passed Omnibus Finances Reconciliation Operate (OBRA) out-of 1993 (codified during the Point 3729 for the Label 38 of your Us Code) enhanced the cost in one.25 % in order to 2 %. Va estimates this boost costs the new veteran without down payment regarding $4.50 thirty day period (in accordance with the mediocre amount borrowed out of $86,000, during the a yearly interest rate of approximately 7.5 per cent, while the expectation that the veteran has elected to invest in the fresh new entire money fee).

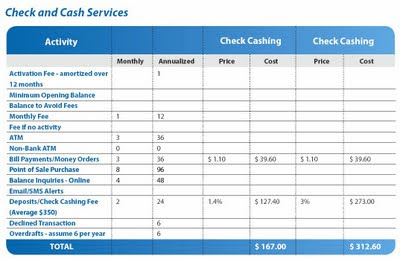

An alternative prepared by the newest Congressional Budget Work environment (CBO) lines increased agenda away from costs. Such as for example, mortgage costs create improve to three % to have off money of lower than 5 per cent; to 2 % getting finance having off payments of five to ten percent; in order to 1.5 percent to have funds which have down money of at least ten %.(8) It’s estimated that it CBO-advised increase will definitely cost the latest seasoned with no down payment an even more $6 a month, compared to present statutory improve. Table 1 depicts the consequences of one’s OBRA provision and CBO choice.

If you’re demanding fairly more compact increases within the monthly premiums on mediocre home-to invest in experienced, the brand new Va system carry out continue steadily to bring professionals (elizabeth.g., straight down mortgage charge, zero off payments and more lenient degree requirements) past what’s obtainable in the current market.

Fax alert of Alan Schneider, Deputy Manager of your own Loan Guarantee Provider, Department from Pros Things, July twenty-seven, 1993

Cumulative six-seasons coupons that would come from implementing it proposal are estimated during the as much as $811.cuatro million. This type of deals try influenced by the enactment out-of legislation.

The Company out-of Experts Issues would be to manage Congress to amend Part 3729 away from Name 38 of one’s United states Password to help you conform to the fresh new CBO option of broadening Virtual assistant mortgage investment charge

1. You.S. Congress, Congressional Budget Office (CBO), Decreasing the Deficit: Expenses and Money Choice (Arizona, D.C., March 1993), p. 329.