Sofi (SOFI) is wanting to reposition itself while the an online financial

Risks on my resource thesis

Ally will be compelled to enhance their put interest rates significantly more easily than simply We enjoy. Pundits generally anticipate one to banks will never be forced to boost interest levels on the deposits as quickly as new given funds speed increases. Yet not, typically it has got not at all personal installment loans in Atlanta times been possible when rates of interest rise.

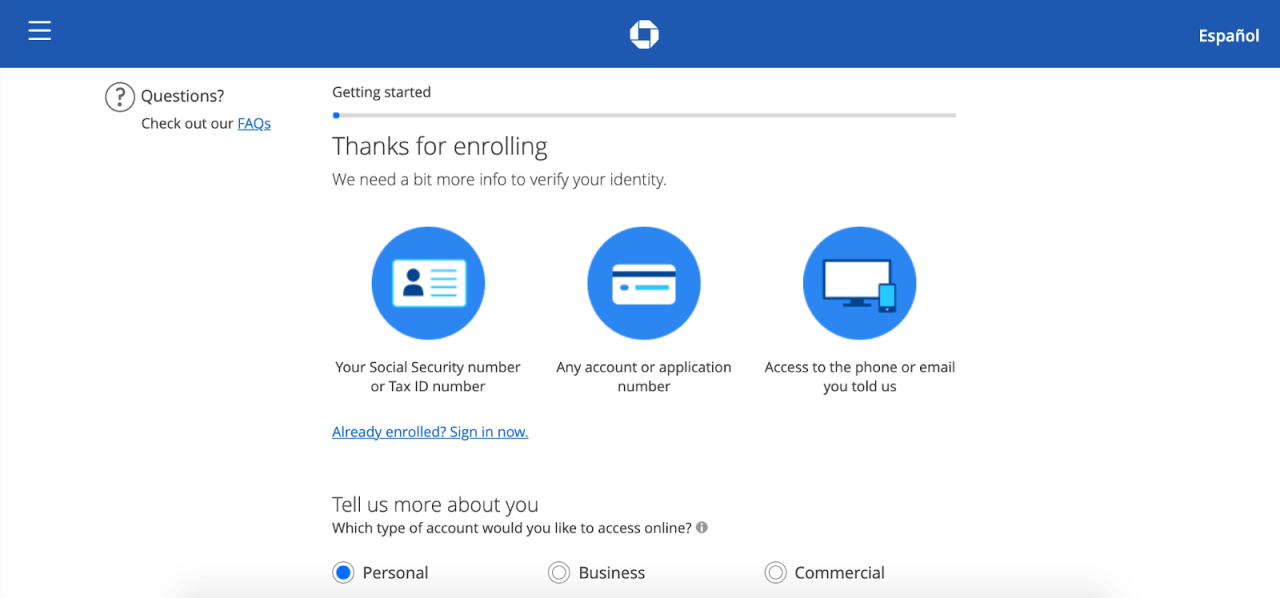

Expanding competition out of one another antique banking companies and you may the fresh new fintech members you may sluggish ALLY’s gains. Conventional banking companies commonly asleep at the controls regarding the fresh new pattern to your online financial. Nearly all banking companies give a global online sense at that point. Very large financial institutions possess well-obtained apps. While doing so, a slew of new participants are becoming to your on the internet financial room. Paypal (PYPL) and you can Cut-off (SQ) need to push growth of the “super programs.” Like, SOFI has just established a plan to spend step 1% APY to your the family savings.

Friend enjoys two masters along the battle if it relates to capitalizing on the brand new trend into on the internet banking. They are currently mainly based while many most other on line earliest financial institutions is actually emerging, but banking are sticky. Ally is sold with a great 96% storage price towards the existing deposit consumers. Ally is online onlypared so you’re able to conventional finance companies, that provide each other online and physically properties, they can reduce the latest overhead required to work on physical financial towns.

Automobile pricing could slide more easily into the 2022 and you will 2023 than Ally already programs. Friend are projecting car or truck cost often fall 15% towards the end off 2023. If auto pricing slip easier otherwise beyond projected, ALLY’s economic abilities could be harm.

Friend stock valuation

Friend features a concrete book worthy of for every display regarding $. It’s been trading around step 1.step one moments concrete publication value. To the earnings side it has been change less than 6 moments TTM income, making it browse inexpensive.

I’ve complete another cash flow valuation centered on a mix from my personal presumptions, historical progress, and you can recommendations provided from inside the ALLYs money presentations. We utilized the after the presumptions obtained from this new companies’ monetary demonstrations:

Considering my personal valuation assumptions: a necessary speed regarding return off ten%, a desired margin of coverage from 20%, and a continuous rate of growth regarding dos.5% immediately following 5 years.

You are able to notice that the new cashflows is try an advertising season. The reason why for this are secured throughout the reducing tailwinds part. The company’s projected get back on complete well-known security is founded on falling vehicle costs offset because of the broadening interest rates. Particularly, the company plans an effective provided finance price of 1.5%-2% on the typical name and you can used-car pricing shedding 15% towards the end regarding 2023. Currently, those two estimates browse old-fashioned i do believe.

Closure viewpoint

I was including Ally to my portfolio for the past times whether it trades near my personal address price of $. As of this composing it is trading a little above you to definitely, but nevertheless better less than my personal estimated fair property value $.

I think the present day price also offers a nice-looking access point to help you traders searching either for expanding returns or even include a monetary on their profile which can benefit within the a rising pricing environment. Whenever i and additionally such COF, I’m not including they to my portfolio up until now given that I prefer Friend and are generally very similar.

ALLY’s user lender has only has just been growing the offerings past a basic deals/checking account. They’ve got brought onboard an investing program, financial originations, and handmade cards. They usually have revealed the capacity to get across-offer their clients for the using multiple financial products.

In order to become a far more complete-services bank, Ally was expanding the brand new breadth of their products. As the 2016 he has got going offering the pursuing the: mortgages, handmade cards, personal loans, and a brokerage to their customers. Talking about an abundance of the new section to grow towards, which comes having execution chance.