How to get a house Guarantee Mortgage with Poor credit

Home guarantee finance makes it possible to discover additional value on the domestic. By borrowing currency facing your property, you can financing domestic fixes and home improvements, that can boost its worth. You may want to use the currency to handle economic problems, or even to repay loans.

That is because home collateral funds and you will family security lines of credit – the 2 most commonly known different borrowing from the bank facing a house – are apt to have much lower interest rates than just personal debt maybe not secured from the a house, for example playing cards.

Utilizing a somewhat lower-notice mortgage, especially if its to cover price of a major home improvement or renovation, is a sensible economic move, Elliot Pepper, CPA, CFP and you will co-creator of Northbrook Economic, told us.

Very first, you need to have exactly what the term of these loans implies: household collateral. You are credit against the property value brand new stake you possess on your own possessions, i.age. your house equity – and that means you must are obligated to pay smaller on your financial compared to home is worthy of. Whether your home is appraised during the $3 hundred,one hundred thousand while are obligated to pay $a hundred,000 on the financial, you have $two hundred,one hundred thousand home based collateral.

The greater amount of collateral you have got of your house, more currency you are able to acquire, another circumstances are equivalent – up to all in all, 85%. One matter relies upon things as well as your money and you will creditworthiness, together with property value the house.

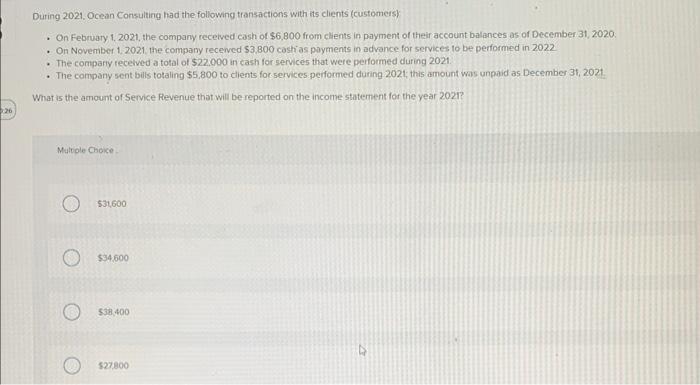

Next, that creditworthiness – given that shown by your credit score – along with your income must be enough to own a loan provider to determine as possible borrow funds sensibly. Minimal credit score necessary to make an application for a home security financing are 620 for many lenders; you will notice an informed rates a lot more than 720.

Credit score Range

Lower than 720, you will likely nonetheless be eligible for a house security loan or perhaps able to re-finance an existing that, says Travis Tracy, an authorized Financial Coordinator at the Fortitude Economic Thought. But once your credit rating are less than you to definitely tolerance, things look a tiny murkier.

What direction to go For those who have Poor credit

If you intend so you can safe a house security loan and now have at the very least the fresh 15 to 20% guarantee required, however provides less than perfect credit, you ought to do something adjust your credit score first, says Lindsay Martinez, proprietor and you will financial coordinator within Xennial Considered.

She suggests downloading your credit reports away from all the about three big enterprises – Equifax, Transunion and you can Experian – and guaranteeing there are not https://paydayloanalabama.com/thomaston/ any discrepancies that could apply at your get adversely. If the there are, she implies getting quick procedures so you’re able to dispute them with the credit institution, and proper her or him. (A credit file isn’t really a credit score; those people are very different one thing, as the former has an effect on aforementioned, that is readable free-of-charge in a lot of charge card on the web profile.)

Possibly items that you have fixed haven’t dropped out of your own declaration but really, which might be impacting your score, Tracy says. You should buy a no cost copy of your own account off for each and every among the three organizations, one per year, within annualcreditreport.

Not paying away from your bank card balances completely monthly have a tendency to increase your borrowing from the bank usage proportion, and that reduces their score. Handling the root of the problem will help restrict tips you might attempt fix they.

Martinez plus advises against applying for even more credit, while the for each app will result in a short-term struck of an effective few what to the rating, otherwise missing people obligations payments. Missing bill costs tend to connect with the borrowing from the bank negatively, also.

That have constant a career more ages and/otherwise a top money can help the probability of going approved having a home equity financing that have low credit, Martinez claims. A high money also can alter your personal debt-to-money proportion, which extremely lenders like to see less than 43%, she states.

Should you want to just do it, Tracy recommends examining along with your newest financial to see if they’d be ready to assist you. Currently which have home financing you are purchasing punctually might highly recommend toward financial your a trustworthy borrower.

All you will carry out, there clearly was some thing advantages strongly recommend up against: using home guarantee to fund individual expenditures, particularly a vacation otherwise really love the fresh vehicle.

Credit facing your home mode placing it right up as security; for people who prevent make payment on bank, one home is caught. Powering you to chance to funds private paying isnt a smart monetary decision.

Bottom line

Delivering a house equity loan with poor credit is challenging, however impossible. With a decreased personal debt-to-income ratio, and a stronger work history, could help counterbalance a decreased credit score throughout the eyes out-of a prospective lender.

But what we need to question is if you desire a loan today. Credit scores are not fixed, therefore the best method so you can proceed might possibly be to help you reassess their spending habits and you will wait until you could potentially boost your credit score. This can help you just obtain the mortgage, however, obtain it at a better interest rate.