Do you Re-finance property Guarantee Financing?

Benefits and drawbacks regarding Refinancing a property Collateral Financing

Lorraine Roberte was an insurance loans in Sheridan for people with bad credit coverage journalist with the Harmony. Due to the fact a personal financing journalist, this lady systems has currency administration and you may insurance rates-related information. This lady has composed hundreds of feedback off insurance rates situations.

Charlene Rhinehart are an expert from inside the accounting, banking, purchasing, real estate, and personal finance. This woman is a good CPA, CFE, Sofa of the Illinois CPA Community Private Tax Committee, and you can was recognized as among Behavior Ignition’s Most useful 50 people for the bookkeeping. This woman is the latest inventor away from Wealth Female Each and every day and you will a writer.

A home collateral mortgage is a kind of shielded loan taken on your property enabling one borrow secured on brand new worth of your property. Furthermore labeled as one minute financial.

For those who have a property collateral mortgage but need best pricing or some other terms, it is possible to re-finance. Find out about exactly how property security mortgage work and you will on an important differences in refinancing options to keep in mind.

Trick Takeaways

- You might re-finance a home collateral financing, but you’ll need certainly to see certification very first, such as with at the very least 20% home guarantee and you can a card reputation the bank accepts.

- There is a variety of re-finance possibilities, as well as a house guarantee loan modification, a different sort of family equity loan, and mortgage consolidation.

- Examine the attention rates, terminology, and you may charges various money before choosing a knowledgeable re-finance choice for your house security mortgage.

- Refinance funds often build significantly more sense whenever there are month-to-month home loan payment discounts minimizing interest levels, and you can stay in your house until your own offers surpass everything paid in settlement costs.

Whom Qualifies To Refinance Their house Guarantee Mortgage?

- Credit history

- Domestic worthy of

- Financial balance

- Money and you can a position history

- Debt obligations

You can examine with your lender to other degree assistance. Such, of many need you to possess no less than 20% equity of your home before you re-finance.

Refinancing Alternatives for Your home Equity Financing

When you refinance your house equity loan, you basically sign up for a special mortgage to pay off the new dated that. The brand new financing provides another type of rate of interest, name, and fees compared to that they replaces.

If you appreciated your own financial for your totally new family collateral mortgage, you can attempt reaching out to her or him about their newest refinancing solutions.

Research rates with assorted loan providers and you can contrast interest rates and you can terms. If you discover things better, pose a question to your modern financial in the event the they are going to suits they. You’re going to get better conditions and still manage to focus on a loan provider your already trust.

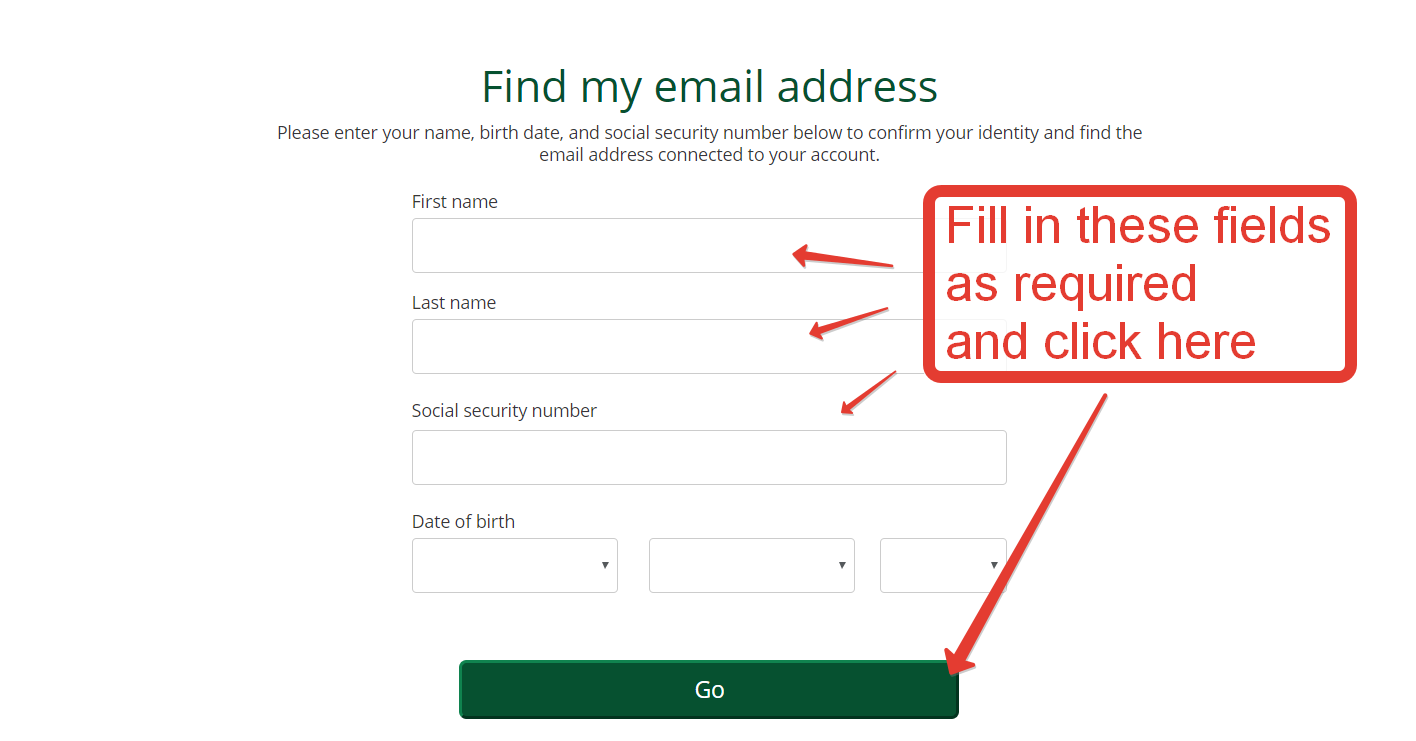

When you look for a loan provider to work with, you will have to make an application for the new re-finance. Within this step, you will need to promote paperwork one to proves you make sufficient money to help make the monthly money. You will probably should also get household appraised and then make yes you really have sufficient collateral.

Once you’ve qualified for that loan, determine what types of refinancing you desire. Typically the most popular brands is a property equity mortgage loan modification, a unique domestic guarantee loan, and home financing combination.

Home Security Loan mod

A house equity loan mod changes the original regards to their mortgage agreement. For example, you may be capable of getting a lower rate of interest otherwise stretch the duration of the loan and that means you do have more time to blow it off.

In place of almost every other re-finance choices, property security loan modification has no need for you to definitely pull out a special mortgage. This might be of good use when you have the lowest credit history or not sufficient family guarantee in order to qualify for an effective refinance. Although not, the lending company has actually a straight to decline the application.