10 You’ll be able to Benefits of Getting Signature loans

Not all personal debt is actually crappy. Think playing cards, where people use them for casual commands, otherwise bringing home financing order your earliest house. As long as you’re responsible – you will be purposefully having fun with mortgage continues and possess a plan to shell out they straight back – carrying obligations might help you are able to debt desires.

Unsecured loans was various other types of debt which might be of use when the put cautiously. Regardless if you are trying to find safeguarded or signature loans, there are many advantages to personal loans.

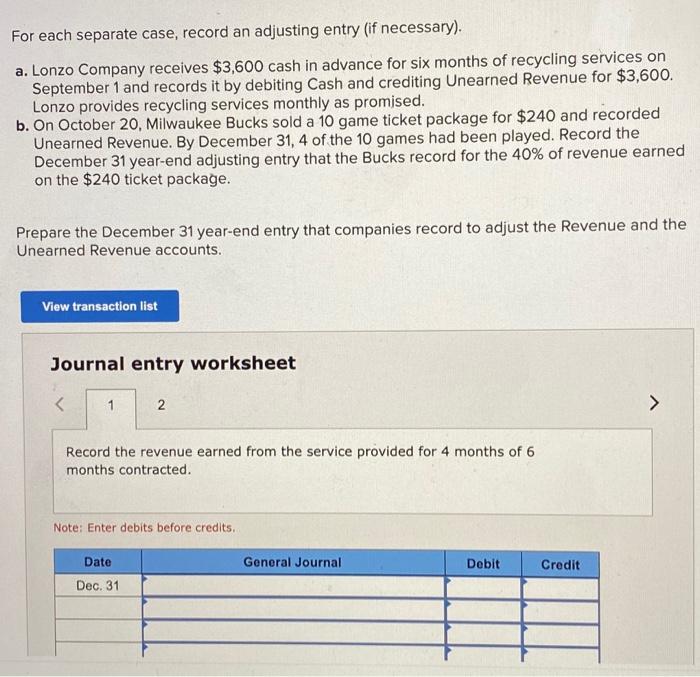

What is a personal bank loan?

Unsecured loans was a swelling-amount of money a bank, borrowing partnership, otherwise on line bank lends in order to a borrower, who will pay back the mortgage from inside the repaired payments to possess a predetermined amount of time. These types of payments include attract and you may any applicable fees.

Borrowers can select from both protected or unsecured loans. The former necessitates the debtor to put up equity to guarantee the borrowed funds, while the second cannot. Personal loans also are recognized for its self-reliance because borrowers are able to use the cash for almost any objective.

ten Benefits of a consumer loan

If you find yourself curious what is a selling point of getting your own loan, the answer is the fact there are many different. Specific unsecured loan experts tend to be their self-reliance, higher borrowing limit, and you may predictable fees schedule.

1. High Borrowing limit Than many other Personal debt

A popular alternative to signature loans is actually credit cards, nevertheless may not be able to borrow an enormous sum. You happen to be best off with an unsecured loan when you are seeking acquire no less than $10,100000. By way of example, SoFi signature loans allows you to use doing $a hundred,000.

dos. Down Rates of interest Than simply Handmade cards

Rates of interest for personal financing are often straight down versus what you’ll discover for credit cards. For those which have a good credit score score, personal bank loan cost initiate around 5%. Even people who have fair credit scores may possibly not be billed pricing about double digits.

Contrast unsecured loan pricing so you can playing cards, which in turn costs much higher rates. For many who carry an equilibrium in your cards, the interest adds up.

3. Collateral Is not Generally speaking Expected

Borrowers taking away unsecured signature loans don’t have to place right up security to help you borrow cash. Whenever you are defaulting on your own mortgage have bad consequences, you may not reduce one property or assets as you would with a protected mortgage.

4. Very easy to Track and you may Would

Taking out one consumer loan is a lot easier than cobbling together with her a much bigger mortgage by using numerous playing cards. Numerous fund often incorporate some other commission repayment dates this article, bank formula, and you may rates of interest. It’s far easier to take out a lump sum making one commission on one lender.

5. Predictable Payment Plan

As signature loans try installment financing, they are available having fixed payment conditions. That implies you will understand based on how enough time you will have to build repayments. Having fixed-rate personal loans, the rate will stay an equivalent and you will probably know exactly how far you’ll be able to pay into the notice from the lifetime of the loan.

6. Fees Identity Offered Versus Most other Financing

Signature loans give an array of installment terminology, out of a couple months for some age. You will be able to find unsecured signature loans giving offered terms and conditions , perhaps around seven yearspare which to help you cash advance which have far less words and significantly highest rates.

seven. Strengthening Credit rating

If you remove a loan, you might be strengthening your credit report. Consumer loan lenders report their fee hobby so you’re able to significant credit agencies – either Experian, Equifax, TransUnion, or every about three. And work out on-go out costs continuously helps to create a powerful credit score and you will increases your credit rating . not, lost an installment can also be advertised, possibly affecting your score adversely.